The Bank of Canada hiked the interest rate by three-quarters of a percentage point on Wednesday September 7th, 2022, the latest move by the central bank in its ongoing mission to rein in runaway inflation.

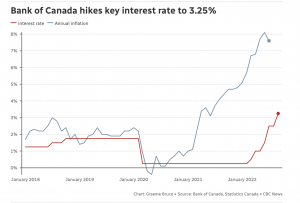

After slashing rates to near zero in 2020 to help stimulate the economy in the early days of the pandemic, Canada’s central bank has moved aggressively to raise lending rates to try to cool red-hot inflation, which has risen to its highest level in decades.

The bank’s rate impacts the rates that Canadian consumers and businesses get from their banks on things like mortgages, lines of credit and savings accounts.

At the start of the year, the bank’s rate was 0.25 per cent. After Wednesday’s move, it’s now at 3.25 per cent.

While Canada’s inflation rate eased somewhat last month from its 30-year high of 8.1 per cent, the bank noted in its decision that most of that decline was due to gas prices, while the rest of the economy still saw “a further broadening of price pressures, particularly in services.”

That persistent underlying inflationary pressure is a big reason why “the policy interest rate will need to rise further,” the bank said, noting that it “remains resolute in its commitment to price stability and will continue to take action as required to achieve the two per cent inflation target.”

The move was widely expected by economists who monitor the bank. While the bank has now hiked its rate five times this year, economists think even more rate hikes are coming before the end of this year.

The move will mean anyone with a variable rate loan is likely to see their payment change in the coming days to keep up with the central bank’s move.

Many mortgage holders have already felt those increases multiple times this year, as rates on variable rate loans have moved from below two per cent at the start of the year to in excess of four and in some cases five per cent today.

If you are concerned about the rising interest rates and what this means for you – send us a message and we’ll help connect your to a qualified professional that will assess if your current product is working for you and your personal situation.