December’s Market Insights

Happy New Year! I hope you had a wonderful holiday season. What a year 2023 turned out to be for the real estate market in BC.

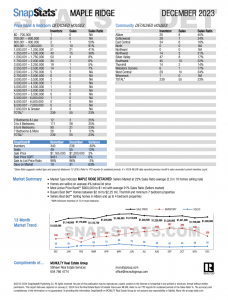

CONDOS/TOWNHOUSES:

The condo and townhouse markets predominantly remain in a seller’s market, except for Mission and Downtown Vancouver, which have shifted to a balanced market. In December, all areas across Greater Vancouver and the Fraser Valley experienced a decrease in inventory levels. Interestingly, some areas saw an uptick in the average sale price, such as Port Moody, Surrey, White Rock, North Delta, Downtown Vancouver, and Ladner. Most other areas saw a decrease in the average sale price, although there were a couple of areas, Burnaby and Abbotsford, that saw no change in the average sale price from November to December. The number of sales in the condo and townhouse markets experienced several decreases, with Port Moody, Cloverdale, and Ladner showing no change in sales from November to December. Conversely, Surrey, Langley, Mission, and Tsawwassen saw an increase in the number of sales.

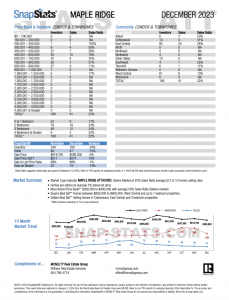

DETACHED HOUSES:

Turning our attention to the detached housing market in the Greater Vancouver area and the Fraser Valley, the majority of regions remain in a balanced market, except for Maple Ridge, North Delta, Cloverdale, Mission, and North Vancouver, which are in a seller’s market. Ladner has shifted to a buyer’s market. Inventory levels decreased across both regions, mirroring the trend in the condo and townhouse market, typical for December due to the holiday season. Home sales in December decreased in most areas, except for Maple Ridge, Cloverdale, and Mission, where sales increased. Regarding the average sale price, subtle changes were observed. Areas like New Westminster, Port Coquitlam, Maple Ridge, Cloverdale, Abbotsford, Mission, and Tsawwassen witnessed an increase, while Burnaby, Coquitlam, Pitt Meadows, Surrey, South Surrey/White Rock, North Delta, Langley, East Vancouver, North Vancouver, and Ladner saw a decrease in the average sale price.

MORTGAGE RATES:

In the mortgage and bond yield landscape, markets are anticipating significant cuts in 2024 potentially as much as 1.25% expected by the end of the year. Bond yields have steadily decreased, prompting major banks to consider deeper discounts on fixed-rate mortgages. Mortgage growth has been weak, growing only 3.4% year-over-year in October, but there are signs of stabilization and increased demand, particularly for variable-rate mortgages.

However, the potential risks lie in the risk of re-acceleration in inflation, which could impact the Bank of Canada’s decision-making on rate cuts. Although consumer spending and business insolvencies are expected to decrease, the overall health of the economy remains a concern. While Canada has a high level of debt, Canadians have $6.5 in assets for every $1 of debt. Despite economic challenges, many Canadians can still afford housing, showing their commitment to prioritizing mortgage payments even in tough times.

SPRING 2024 MARKET PREDICTIONS:

The upcoming spring market is expected to be busier. Some sellers are gearing up to list, and we anticipate more buyers will be out shopping but inventory may not see a significant increase. The average sale price may not see a huge increase due to the current interest rates. The limited inventory could lead to a modest increase. Multiple offer situations are not expected to be as intense as in 2021 and 2022; although properties priced at market value may attract more than one offer, maintaining a balanced market.

As we look ahead to the upcoming year, if you or your family/friends have real estate goals, please don’t hesitate to reach out. We can create a customized plan to help you achieve your goals in 2024. Curious about your market value? Send me a quick note, and I can run some numbers based on the current market and pricing forecasts. Don’t hesitate to contact me for a detailed property analysis or an in-depth discussion about a specific area. I am always happy to help. Click here to contact me.