What an interesting month. We’ve got a ton to discuss, including news, sales, listings, and more. Let’s explore the details!

To start, David Eby’s recent announcement about the comprehensive rezoning legislation for the entire province has caused quite a stir. This legislation now allows the construction of multifamily units on any single-family lot, significantly altering housing prospects throughout BC. This action is a response to the record-high immigration numbers, with the immigration minister confirming plans to increase immigration to 500,000 people next year and maintain that target for the following three years.

In October’s Vancouver real estate stats, sales increased moderately compared to last year but are still well below the 10-year average (-29.5%) due to high mortgage rates deterring buyers. New listings are rising, and while overall inventory dipped slightly, the market is moving toward a balanced state, and in some cases, a buyer’s market. The HPI price has decreased for three consecutive months, while the median price has gone up.

Regarding market dynamics, the average days on the market remain at 12, indicating a quick turnover for well-priced properties. Despite the overall slowdown, high-demand properties still attract significant interest, leading to multiple offer situations. Well-maintained, well-priced properties in desirable neighbourhoods continue to sell quickly and, in some cases, with competition.

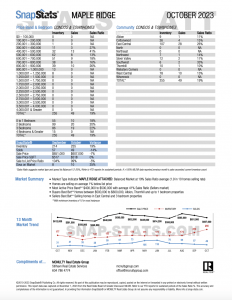

CONDOS/TOWNHOUSES:

The condo and townhouse markets remain mostly in a seller’s market, with exceptions in Surrey and Downtown Vancouver, both of which have shifted to buyer’s markets. Maple Ridge and Surrey have transitioned to a balanced market. In October, several areas across Greater Vancouver and Fraser Valley experienced an increase in inventory levels. However, some areas, including Port Moody, North Delta, Abbotsford, and Mission, saw a decrease in inventory. Interestingly, Downtown Vancouver was the sole area that didn’t observe any change in the number of listings sold. In October, more areas experienced a decrease in the average sale price, while a few, like Burnaby, Port Coquitlam, Port Moody, Langley, Mission, Downtown Vancouver, and North Vancouver, saw price increases. This can be attributed to stable interest rates in October and the natural slowdown in the fall market compared to the spring and summer.

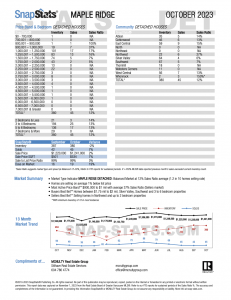

DETACHED HOUSES:

Shifting our focus to the detached housing market in the Greater Vancouver area and the Fraser Valley, most areas are now in a balanced market. The exceptions are Burnaby, Port Moody, and Pitt Meadows, which remain in a seller’s market, while South Surrey/White Rock and Surrey are in a buyer’s market. This attracts buyers looking to upsize, especially in South Surrey/White Rock and Surrey. Sales were fairly evenly distributed across the Greater Vancouver area and the Fraser Valley. The only areas that showed no change in the number of homes sold were Mission and North Delta. In contrast, Burnaby, New Westminster, Port Moody, Pitt Meadows, Maple Ridge, and Ladner all saw an increase in home sales, while Coquitlam, Port Coquitlam, Surrey, South Surrey/White Rock, Cloverdale, Langley, Abbotsford, and Tsawwassen observed a decrease in home sales during October. As for the average sale price, most areas experienced decreases, but Port Moody, Maple Ridge, North Delta, Abbotsford, and Tsawwassen saw increases in October. Finally, the average sale price in Langley remained stable from September to October.

FORECAST:

Looking ahead, it is expected that the current subdued level of activity will persist throughout the remainder of the year and will likely spill over into 2024, largely influenced by the rate hikes implemented nearly two years ago now compounded by seasonal fluctuations. Additionally, the slowing down of the US markets is projected to have a ripple effect on the Canadian economy and real estate landscape, further contributing to the prevailing market conditions as consumer sentiment remains pessimistic.

Let’s work together to create a customized plan for your real estate goals, whether short or long-term. Reach out if you’d like to discuss over the phone or in person. Curious about your market value? Send me a quick note, and I can run some numbers based on the current market and pricing forecasts. Don’t hesitate to contact me for a detailed property analysis or an in-depth discussion about a specific area. I am always happy to help.