The Latest Real Estate News & Market Insights For June 2024

The Vancouver real estate market has largely held strong for 2024 with home prices rising in the first five months of the year, but things look like they could take a turn. High interest rates for two years, a ten-year low in sales volumes, and a spike in consumer and business insolvencies are all pointing to a decline in real estate prices.

The June numbers are out, and we’ll dive into them to discuss what’s been happening. Now I have a lot to get into so bear with me here. I don’t want to make this too long so please give me a call if you would like to discuss in more detail regarding the updates on insolvency figures, the SSMUH initiative, and new tenant laws requiring landlords to give four months’ notice if the new owner plans to live in the property.

I’d like to start off with the health of the market, aka how many homes sold. And June was pretty slow across the board. June was pretty slow across the board, with just under 2,400 homes sold—a 19% drop from last year. This is significant, considering last year was already on a slower trend. Month-over-month, there was a substantial 13% decline. Although sales typically slow down in June, this year’s decline was even more pronounced. This marked the second consecutive month of declining sales.

With sales 24% below the ten-year average and rising inventory levels. It’s the slowest June dating back to 2019 as well. And it is the third sort of year in a row where we’re seeing the entire year slow down in sales. Owners are choosing to stay in their homes, while buyers remain hesitant. The expected rate cuts did not bring buyers but instead increased new listings and inventory.

June saw 5,737 new listings, a 7% increase year-over-year, an 11% decrease month-over-month, but a 3% rise above the ten-year seasonal average. This marked the third month of elevated listings. While this may sound like good news for sellers, it’s typical for June to be slower than May. This year, however, has seen more listings than usual, with seem sellers eager to move.

Inventory stood at 13,405, a modest 0.5% increase month-over-month. However, inventory is up 35% year-over-year, reaching a four-year high and 20% above the ten-year average. This marks the sixth consecutive monthly increase in inventory, offering more options for buyers.

An interesting outlier is that while detached and townhome inventory increased month-over-month, condo inventory actually decreased in June compared to May. This is surprising, especially when compared to Toronto, which is experiencing a high level of active condo listings. We’ll see how this trend evolves in the coming months.

The overall sales-to-active listings ratio for June was 18%, down 3% month-over-month, shifting from a seller’s market to a balanced market for the first time since January. This is the second consecutive monthly drop, and three months would indicate a trend.

Average days on market now stand at 14 days. For buyers and sellers, this is an important metric. If a home is accurately priced, it should sell within or around two weeks. If not, days on market will continue to climb as buyers are increasingly selective, moving us toward a buyer’s market. Sellers need to price accurately to avoid chasing the market down until it hits a bottom and starts to recover. For buyers, long days on market indicate potential opportunities.

Insolvencies are a growing concern, with consumer and business insolvencies in British Columbia, Alberta, Ontario, and Quebec rising by 1,750% since mid-2022. This financial stress is likely to lead to business layoffs and forced property sales, which could further drive down prices.

Now, let’s discuss the new tenancy laws in BC, which could have a detrimental effect on the rental and sales markets. Effective July 18, landlords must give tenants four months’ notice if they intend to use the home personally or sell the property. This change could complicate transactions and mortgage approvals, making rental properties harder to sell and potentially pushing rental prices up as investors withdraw from the market.

Lastly, let’s discuss the multiplex plan, the small-scale multi-unit housing initiative. As of June 30, all cities are required to have adopted this initiative and established their bylaws regarding permissible constructions. By April 19, the city of Vancouver had received 113 development applications, with most for triplex and fourplex units. Only 19% of the applications are for sixplex units. Additionally, the city offered increased density incentives for projects consisting solely of rental units, allowing up to eight units per lot. However, as of now, no one has applied for these incentives, likely due to the unappealing costs involved.

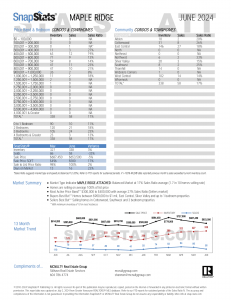

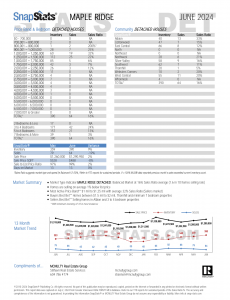

CONDOS/TOWNHOUSES:

Another month saw inventory levels increase in most places, except for Langley, Abbotsford, North Vancouver, East Vancouver, and Ladner, which experienced a slight decrease. The number of homes sold in June was down almost across the board in Greater Vancouver and the Fraser Valley. However, there were some exceptions; North Vancouver didn’t see any changes between May and June in the number of homes sold, while Port Moody, Cloverdale, and Langley saw increases compared to May. Moving on to the average sale price, several areas experienced decreases, including Burnaby, New Westminster, Port Coquitlam, Pitt Meadows, Maple Ridge, South Surrey/White Rock, Langley, Abbotsford, Mission, East Vancouver, North Vancouver, Ladner, and Downtown Vancouver. Conversely, Coquitlam, Port Moody, Surrey, North Delta, Cloverdale, Vancouver’s Westside, and Tsawwassen saw increases in average sale prices. The majority of areas are still in a seller’s market, but a few are shifting into a balanced market, such as Burnaby, Maple Ridge, Surrey, North Delta, Mission, and Downtown Vancouver.

DETACHED HOUSES:

Now, turning to the detached housing market: similar to May, inventory has risen in almost every city across Metro Vancouver, Greater Vancouver, and Fraser Valley, except for New Westminster, Pitt Meadows, North Delta, and Cloverdale, which saw a decrease last month. The majority of areas in Greater Vancouver and Fraser Valley saw the number of homes sold decrease, except for New Westminster, Pitt Meadows, Abbotsford, and Tsawwassen, which saw an increase in the number of homes sold. Burnaby was the only area that didn’t see any movement in the number of homes sold between May and June. The average sale price varied by area. Areas like Burnaby, New Westminster, Port Coquitlam, Maple Ridge, South Surrey/White Rock, North Delta, Vancouver, and North Vancouver all saw the average sale price increase compared to May. Coquitlam did not see any change in the average sale price between May and June, but Port Moody, Pitt Meadows, Surrey, Cloverdale, Langley, Abbotsford, Mission, Tsawwassen, and Ladner all saw a decrease in the average sale price for June. Although a few places remain in a seller’s market (Burnaby, Pitt Meadows, Cloverdale, Langley, and North Vancouver), many areas have shifted into either a balanced market or a buyer’s market. New Westminster, Coquitlam, Port Coquitlam, Maple Ridge, North Delta, Abbotsford, Mission, Vancouver, Tsawwassen, and Ladner have all shifted into a balanced market, whereas Port Moody, Surrey, and South Surrey/White Rock are now in a buyer’s market.

If you have been thinking about buying or selling recently, feel free to reach out. We can create a customized plan to help you achieve your goals. Curious about your market value? Send me a quick note, and I can run some numbers based on the current market and pricing forecasts. Don’t hesitate to contact me for a detailed property analysis or an in-depth discussion about what’s happening in the real estate world. I am always happy to help.